Labor populist politics or a big policy gamble?

What does Bill Shorten’s proposal to remove the refund on excess franking credits mean?

We have had several enquiries from clients wondering what this all means, so we have put together an overview of the key issues to explain how this could affect you.

Firstly, it is important to point out that these changes are only ‘proposals’ made by Bill Shorten, the leader of the opposition party, and are evolving as the party gauges how popular the proposals are with the Labor constituents and the general public.

To affect change, Labor would need to win the next election, and be in a strong enough position to successfully get the changes passed through the House of Representatives and the Parliament by majority vote. Outside the possibility of a double dissolution, the next election must be held between 4 August 2018 and 18 May 2019, so it is likely that the details and complexities of this policy will be hotly debated by both parties as they attempt to increase their numbers in the polls.

In a nutshell

This is a policy that proposes to take away a tax refund that mostly benefits people (and/or their super funds) in the lowest tax brackets (see the first two tax brackets in Table 1.). So, it will be tough for Labor to maintain the argument that the reason for the proposal is because low income earners are being disadvantaged by the wealthy elite who are getting more tax refunds than they are. There are a lot of complexities behind all this, so be prepared to hear more debates and conflicting information from both sides of politics and the media.

Table 1.

2017–2018 Individual income tax rates (Australian residents)

The above rates do not include:

- The Medicare levy of 2% (legislation pending to increase this to 2.5%).

- The low-income levy, which effectively increases the tax-free threshold to $20,543.

Self Managed Super Funds (SMSFs) and Pensioners

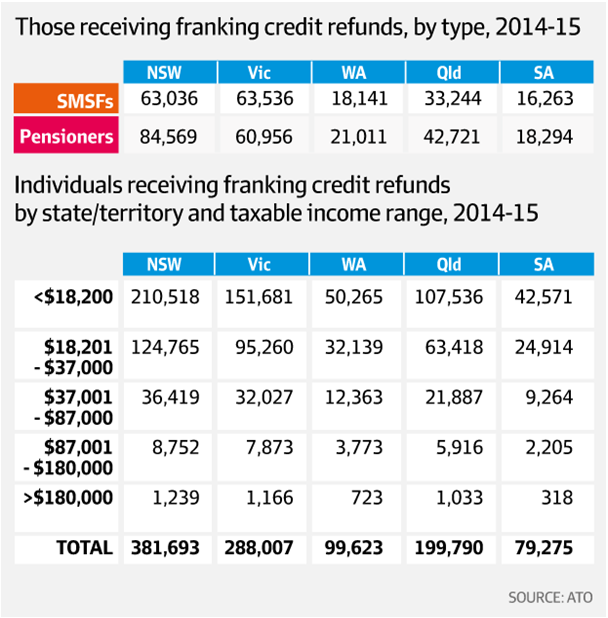

However, you can see in the top section of Table 2. below, that in the 2014-2015 year there were large numbers of SMSFs and Pensioners across every state of Australia benefiting from the tax refunds from excess franking credits.

Australia is very unique in the way it refunds taxes on dividends and provides tax-free income streams for retirees in superannuation. No other country in the world provides this benefit. The Labor Government will argue that this combination of benefits is creating an increasingly larger group of wealthy seniors who are spending longer periods of time paying no tax as their life expectancies increase. Official figures show that the proportion of older Australians paying no income tax has increased from 73% in 1995 to 84% in 2014, and is growing. These are issues that the Government will need to address whoever is in power.

In summary, those affected by Labor’s proposals would include a relatively small number of people on the Full Age Pension, a slightly larger number of people on Part-Pensions and then the Self-Funded Retirees (drawing tax-free super pensions). Many of our clients in these categories stand to lose what has become a significant supplement to their income, ranging from hundreds, thousands to tens of thousands of dollars a year.

To soften the original announcement, Labor have also announced that low-income retirees will now be excluded from the franking credit crackdown as will SMSFs with at least one Age Pensioner (or Centrelink allowance recipient) before 28 March this year. The problem with this approach is the that those SMSF retirees who did not qualify for the Age Pension before 28 March 2018, will not be able to access the same level of Age Pension entitlements to supplement their superannuation incomes, creating an unfair, two-tiered and complex system for SMSF members and superannuation going forward.

Individuals

The bottom section of Table 2. below shows that the two lowest income brackets for Individuals ($0 – $18,200 and $18,201 – $37,000) make up 86% of those that qualify for the excess franking credits refunds. This highlights that low income earning individuals are mostly those receiving some kind of benefit from the refund of excess franking credits.

What are franking credits and dividend imputation?

A portion of Fintech’s diversified portfolios are invested in Australian shares, which benefit from some franked dividend income. Dividends are the amounts paid out from those Australian shares using profits that the companies have made during the year and often come with an imputation or franking credit attached.

Dividends are grouped together with any other income or earnings you make during a financial year to determine your overall taxable income. When a large company earns a profit, it is required to pay tax on that money at the corporate tax rate of 30%.

Before the dividend imputation system was introduced in 1987 by the Hawke/Keating government, the tax office would firstly tax the company, and then secondly the investor when they received the dividend, in effect a form of double taxation.

Since the introduction of the dividend imputation (or franking credit) system, when you have received a dividend from an Australian share in your portfolio, you have only been taxed on the difference between the company tax rate of 30% already paid and your marginal tax rate.

Three examples of how franking credits are applied:

- If your Individual tax rate was at the highest level of 47% (inc 2% Medicare Levy), then you would pay tax at 17%, the difference between your tax rate of 47% and the 30% franking credit for the company tax already paid.

- Conversely, if your Individual tax rate was 30%, then you would not pay any tax on dividend income received, as it would be offset completely by the 30% franking credit for the company tax already paid.

- Refunding of excess franking credits – If your tax rate was 0% (same as the tax-free pension phase in super), the you would be eligible for a refund of the excess franking credit. That is, the entire 30% company tax paid is added back to your income as a credit, creating a tax refund.

This has made owning ‘blue chip’ Australian shares paying dividends with imputation or franking credits a powerful strategy, especially for investors whose marginal tax rates are less than the corporate tax rate of 30%. Since the year 2000, when the Howard/Costello Government made excess franking credits fully refundable, the cost to the federal budget has ballooned to about $5.6 billion a year, and growing.

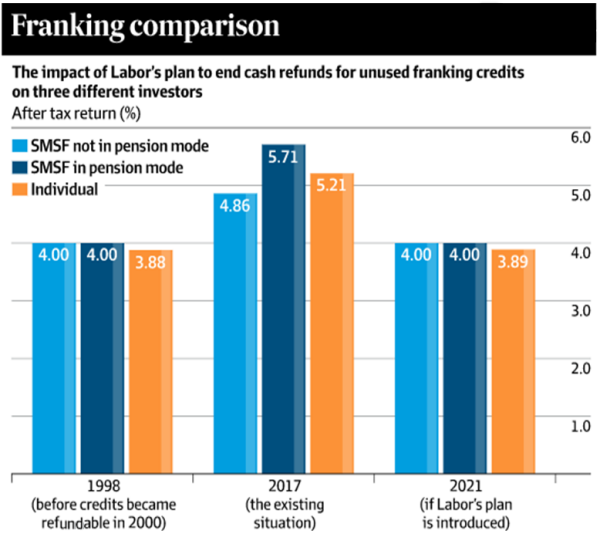

Table 3. below provides a comparison of the impact of Labor’s plan to end cash refunds for unused or excess franking credits across three different investor structures.

Assumptions:

- Dividend Yield 4%

- Franking Rate 100%

- Corporate Tax Rate 36% (1998), 30% (2017, 2021)

Comparison Chart Source: BDO Interact

In summary

The refunding of excess franking credits has been particularly beneficial for members of superannuation funds or SMSFs that are in tax-free pension mode (over age 60 and fully retired), as it has added approximately 1.71% per annum to the after-tax return. A benefit of approximately 1.33% in additional returns applies to Individuals who own Australian shares with franking credits and have no other earnings in their own names, as they are also on a 0% tax rate.

The Turnbull government will argue that on 1 July 2017, it introduced the $1.6 million limit on the amount of money that can flow tax free from pensions in super (Transfer Balance Cap), which has already curbed some of the costs of super concessions. Under the new rules, SMSF members with more than $1.6 million will be paying tax on some of their earnings that will offset the value of their franking credits, limiting their refunds.

It will be very interesting to see whether Shorten’s radical policy announcements to remove the refund on excess franking credits will have enough appeal to the tradition Labor heartland or become a big policy mistake. There may be enough weight with disgruntled self-funded retirees to garner support and momentum for the Turnbull Government to win a second term and continue implementing the existing policies that only came into effect from 1 July 2017.

Please contact our office if you wish to discuss any of the above in relation to your specific circumstances.

Leave a Reply

Want to join the discussion?Feel free to contribute!