Three important ways to think about investing in the current markets

- Portfolio falls are temporary moves that become permanent losses only when investments are sold

- Market volatility can be an investment opportunity for the longer-term.

- Investment success shouldn’t be measured against beating short-term returns – it’s about being on track with the right strategies to achieve your important financial and lifestyle goals

COVID-19 has brought massive short-term changes to our world, economy, and markets. Looking back on the first quarter of 2020, there’s a dizzying amount of data and information to digest and understand. So, here are a few important but simple points to keep in mind about investment markets, despite the unusual times we’re in.

Selling Locks in Losses

Falls in investment values don’t become losses unless they are sold when markets are down. Faced with this information, you might expect all investors to simply stay invested through market uncertainty. However, this is often not the case, even when investors know what’s right. People’s emotions can get the better of them, leading to decisions that can erode the value of their portfolios and make it hard to stay focused on the important financial and investment strategies that will maximise their financial outcomes.

Conversely, investors that stick to their strategy (that is, re-balancing or behaving counter-cyclically after a market decline) tend to produce better results over the long term than medium-term trend followers. That is, those that sell after falls and buy after rallies.

Selling after a market decline, locks in not just one loss, but likely two. Historically, markets have typically rebounded after a large decline. If you get out of the market, it’s very likely that you’ll miss the rebound. Missing the rebound is not just a lost opportunity, it statistically sets you up for lower long-term returns than if you hadn’t done anything.

Exhibit 1 illustrates this point. It shows $1 invested in the equity markets, represented by the MSCI USA Index, at the beginning of the year 2000. Three scenarios emerge from the global financial crisis in 2008-2009:

- One investor holds on after the fall

- One sells and waits a year before buying back in, and

- One gets out and stays in cash

The decision makes a significant impact on portfolio returns, with the one staying put ending with $312, nearly 50% more than the one who spent a year in cash, and almost 5 times the value of the one who got out of stocks and stayed out.

Market declines, even double digit ones are to be expected from time to time. In fact, the willingness to see portfolio values move around is one reason our clients are rewarded for investing over the long term. We think staying focused on the long term can help people make better short-term decisions.

Taking Advantage of a Market Decline

For investors that think about markets in a long-term way, market volatility presents an investment opportunity not a risk. Imagine that you own a farm, and every day your next door neighbour offers to either buy your farm or sell you his farm. Some days, when crop prices are high, he may offer you way more for your farm than it’s probably worth, and when crop prices fall, he offers you his farm for peanuts.

When prices are low and people are selling, should that make you want to sell? Should your neighbour’s depressed mood lead you to sell? Because that seems to us to be the best time to buy. A better time to sell would be when your neighbour is very optimistic and you can get a much higher price for your farm.

We think it’s the same with investment markets, they are there to serve us, to allow us to buy when prices are low and to sell when prices are high. Don’t follow the herd, they’re not looking out for you.

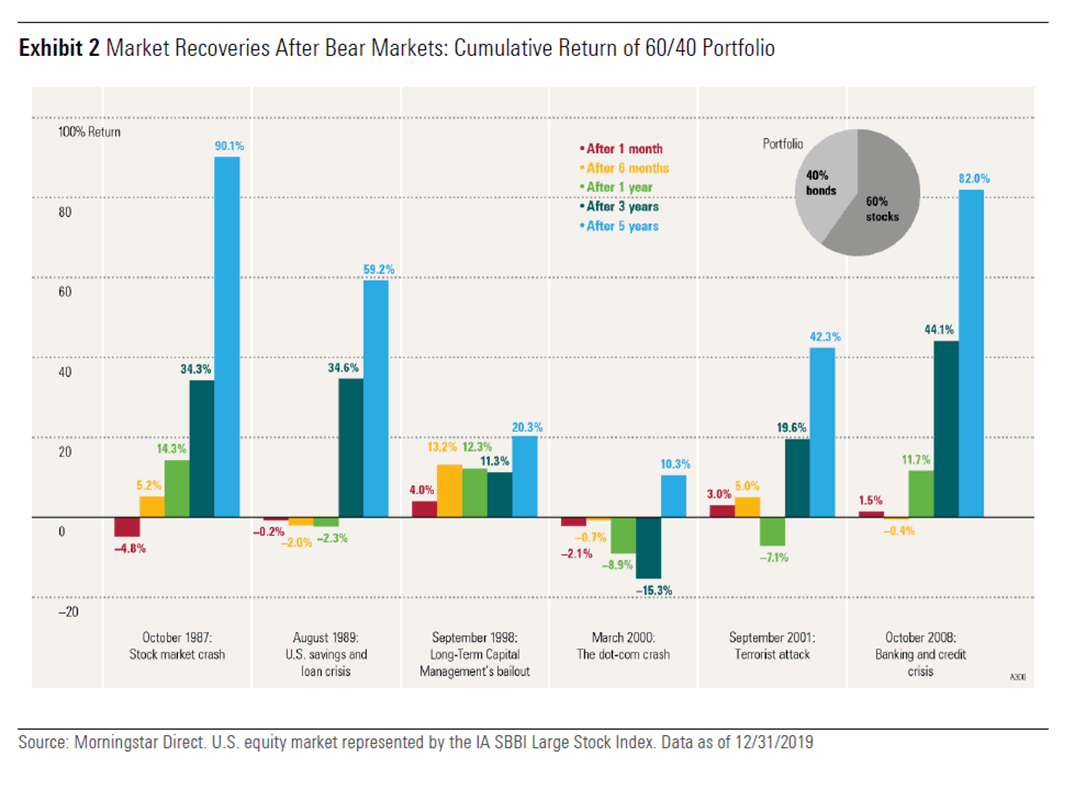

Again, looking at past market declines can give us a better idea about what typically happens in these environments. Exhibit 2 shows that the three and five year returns after a decline are significantly positive. Only the dot-com bubble burst was not followed by a considerable increase, largely because the global financial crisis intervened. For most, however, crises represented opportunities to invest.

Am I on Track?

Investments are one of the six areas of financial advice that require strategies as part of an ongoing plan to achieve the financial goals that are important to you in life …click here to see Fintech’s full spectrum approach. For most individuals, important underlying questions are often centred around “will I have enough money” and “am I on track?” Well designed financial strategies do not rely solely on investment returns. But we know that many people substitute an evaluation of their investment performance in the short-term for a sense of their progress toward their goals in life. Evaluating the portfolio tends to lead to simplistically comparing portfolio performance to benchmarks or peer groups. This is an incomplete way to the assess investment strategies, but more importantly it can focus investor attention on the short term. This can unwittingly lead to wealth destruction if the investor lets fear or greed override their emotions and decision making – switching from one strategy to the next (again, see Exhibit 1).

We think a better question to ask is whether the financial strategies that make up your plan are still appropriate and will maximising your overall progress towards your goals. Bringing the conversation back to the purpose of the plan and the time frames involved, can help shift the conversation from short-term performance to achieving the things that are most important to you over the long-term. This also allows for the power of compounding returns to weave it’s magic, or as Einstein famously put it “the eighth wonder of the world”.

Plans that are built for volatility and with redundancy, recognise that investment returns can be uncertain when viewed with a short-term focus. However, by having your investment structures professionally designed and implemented as part of your overall financial strategies, you are able to overcome uncertainty and stick to your plan. Despite short-term declines, your long term goals are able to remain on track with the right financial advice and strategies in place.

It is especially important in times of disruption and uncertainty to focus on these three points, and take advantages of the opportunities that arise through periods of market volatility!

Please stay safe and well while the Coronavirus runs its course.