Key Takeaways

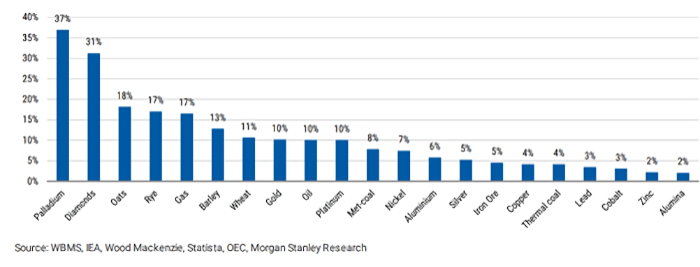

- The rapid escalation between Russia and Ukraine has dramatically shifted investor sentiment. We are witnessing a meaningful setback in key financial markets, prompting volatility and negative speculation. This is normal amid uncertainty, but it is worth stepping back to understand the fundamentals of the situation.

- A wide range of potential scenarios and outcomes are possible from here. Your portfolios are highly researched and diversified to minimise risk, and we should try to avoid predicting every possible pathway and instead look at the potential implications across assets.

- Energy prices are an area we believe will be vividly impacted.

- Russian stocks only account for around 2.9% of the emerging-markets basket . So, while the local market reaction has been severe, the numbers don’t argue for a significant long-term impairment across other emerging markets.

- During wars and conflicts, the historical track record of the equity market is mixed, with some conflicts such as the Crimea invasion in 2014 leaving equity markets barely changed. Those with a long time horizon will likely be well placed staying invested, statistically speaking.

Setting the scene – Why Russia/Ukraine Concerns Matter

The Russian invasion of Ukraine is increasingly fluid and potentially harrowing. As investors – not as politicians or news reporters – we thought some perspective on the investing implications from a multi-asset perspective is warranted.

As a client of Fintech Financial Services, you will be aware that we are advocates of long-term investing where it can be aligned to your goals and aspirations. Inherently, we believe it is important in situations such as this to keep one’s bearings and not lose a long-term perspective. Unsettling headlines can lead to fear, which in turn can lead to sub-optimal decisions, which in turn can undermine long-term return objectives. Understanding what is important to you and staying focused on the ‘financial advice & strategies’ that will achieve those things in the long term is the key.

At the same time, we can’t just ignore risks. As fundamental investors, we believe it is important to assess and understand any potential long-term market implications from this type of potential conflict. While there are certain impacts that are relatively clear and mostly well understood by market participants, there are also other less obvious impacts that need to be assessed.

Furthermore, it is important to be alert and prepared during periods of uncertainty, as short-term fluctuations and volatility can uncover potentially significant investment opportunities at attractive valuations.

First-Level Impacts: Energy Markets Must be a Primary Focus

It is fairly clear that the Russia/Ukraine conflict has potentially significant energy market implications. This is particularly true in European natural-gas markets, which are supplied mostly by way of imports from Russia. Russia also is a significant player in global oil markets, and speculation around the price impact from curtailed supply out of Russia has already embedded a “geopolitical risk premium” into oil prices.

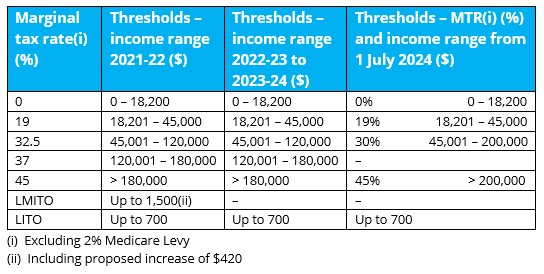

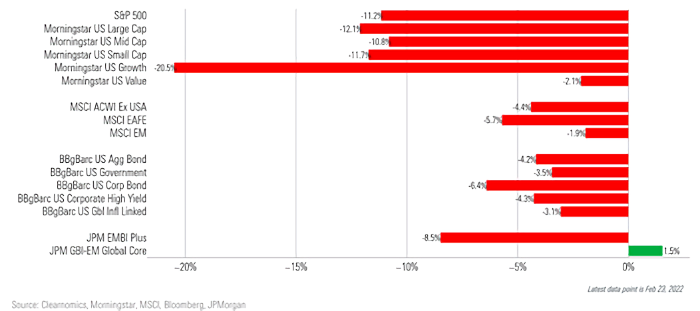

As well, to the extent that the sanctions imposed increase in severity, there could be significant incremental friction imposed upon an already stressed global supply chain, which in turn could exert more significant inflationary pressures in other commodities that Russia supplies to the world. Between Russia and Ukraine, the two countries account for 25% of global wheat exports, and Ukraine is responsible for 13% of corn exports , so food inflation is a major risk. Additionally, Russia is the largest producer of ammonium nitrate and is a large exporter of palladium, platinum, and aluminum.

In an environment of rising global inflation, this increases the pressure on central banks globally to tighten monetary policy. Specifically, central banks may feel compelled to act in order to dampen inflationary pressures, most likely through increases in policy rates (including interest rates). In the event that rates reset higher, this generally represents a headwind for fixed-income investments – all else being equal – particularly in developed markets.

Equity markets, while certainly volatile of late, will be impacted differently. As sanctions are now imposed on Russia by western countries at scale, the Russian economy and equity market could weaken further. We’ve already seen the MSCI Russia Index (a favored index for Russian stocks) fall by more than 60% year-to-date in 2022 .

Elsewhere, the prospect of accelerating inflation in developed-market economies may come with cost-of-capital implications, especially for longer-duration growth equities (such as the big technology names with lofty valuations), which may not yet be fully priced in. And, of course, there are potential beneficiaries, such as global energy companies who could benefit from an extended period of elevated energy prices.

Exhibit 1 Energy Stocks are Clear Outperformers in Global Equity Markets Year-to-Date

Energy Market Implications Will be Felt Most in Europe

Russia (and more broadly the other so-called “Commonwealth of Independent States,” or CIS) is an important supplier of energy to the world. With production of 14.7 million barrels per day , Russia met 16% of the world’s petroleum (oil and refined products) needs and on this basis is the world’s second-largest producer behind the United States. At 679 billion cubic meters per year, Russia produces 17% of the world’s natural gas, and again is the world’s second-largest producer, behind the United States.

Exhibit 2 Russia Share of Commodity Production is Meaningful

Perhaps most importantly, Russia looms largest as an energy supplier to Europe. Including other CIS countries, Russia supplied approximately 43% of Europe’s imported oil and petroleum products, as well as around 56% of Europe’s imported natural-gas supply, in 2020[1]. Moreover, approximately 33% of gas supplied by Russia to Europe is transported through Ukraine. The key message here is simple: when conflict bubbles up between Russia and Ukraine, energy markets take note.

The trouble spot is clearly Europe. The region has become increasingly reliant on imported energy supply as a combination of policy initiatives, regulatory-driven supply curtailments and a lack of investment in local conventional-energy supply growth. Together, this has conspired to cause local energy supply to shrink in recent years. With global-energy prices substantially rising through 2021 and into 2022, the aforementioned local-supply issues in Europe served to exacerbate the local vulnerabilities, leading to substantially more rapid increases in European energy prices than those experienced globally.

The Impact of Sanctions and Potential Knock-On Effects

How Russia reacts to sanctions, and how the rest of the world reacts to Russia’s reaction, could significantly impact energy markets. It is possible, even likely, that in response to sanctions, Russia may restrict energy supplies in an attempt to exert geopolitical leverage on the West.

As well, it is entirely possible that there could be damage inflicted on Ukraine’s gas infrastructure, as well as potential restriction of gas supplies through other European pipelines, such as Yamal and the controversial Nord Stream 1.

The United States has been working to source additional gas supplies (predominantly liquefied natural gas or LNG) into Europe. However, while there may be enough gas to mitigate losses from Ukraine, it is unlikely that there is enough spare LNG capacity to compensate for other pipelines being cut off.

There is also a risk that Russia will seek to restrict its oil exports. This brings in other oil exporting countries, who may or may not offset any oil-supply cuts. For example, to date, Saudi Arabia has shown no indication that they are willing to backfill this void. In response to such a curtailment, the International Energy Agency could help coordinate a release of oil supply from various strategic petroleum reserves to help offset the supply shortfall, but this is far from guaranteed. Bear in mind, as well, that progressions in negotiations around reinstatement of the Iranian nuclear accord could eventually bring additional barrels from Iran onto the oil market, but this deal is by no means a lock, either.

Inflation Thoughts: It Could Get Worse Before It Gets Better

Severe sanctions are already being imposed against Russia, but this could get worse – and may add to preexisting inflation pressures. The potential sanction list below is far from exhaustive, but it could foreseeably include sanctioning the three largest Russian banks (VTB, Sberbank, and Gazprombank), removing Russia from SWIFT, or sanctioning exports of critical technology and members of Putin’s inner circle, among others.

Russia’s response to these sanctions could prompt an increased risk of inflation. This is likely to include disruption of critical energy, food, and industrial commodities. By some estimates, these disruptions could add up to 2% extra headline inflation in developed markets, most notably in Europe[1]. This, in turn, could potentially serve to give further impetus to accelerated tightening of monetary policy, given the inflationary backdrop and already hawkish signals from central banks. On the other hand, there is a chance that rate hikes could be delayed to buffer against economic uncertainty, plus fiscal spending could be loosened to cushion the blow to real incomes.

Digging into some of the details, we see that the energy component of the inflation calculation varies from region to region. In the US consumer price index (CPI), as an example, energy price changes accounted for 7.5% of the index in late 2021[2]. That doesn’t seem all that significant; however, we can see that when energy prices rise substantially, as they did in the January 2022 CPI report, this can significantly influence the overall inflation number. In this report, energy-price increases of over 25% year-over-year contributed close to a 2% CPI change, which was over a quarter of the 7.5% year-over-year change in the index.

Fixed Income Implications: The Defensive Ballast Requires Extra Care

Inflation tends to erode real returns, and rising policy rates (deployed in an effort to offset inflation) tend to negatively impact bond pricing, creating a “double-whammy” of sorts for fixed-income investors.

However, in this instance, there are some important and potentially offsetting considerations. Generally, increases to policy rates tend to be driven by an economy that could sustain higher rates. If central banks sense a vulnerability in the economic environment, they may act conservatively and decide to pause on rate hikes. Certain fixed-income markets should benefit from that.

Even if central banks do raise rates in line with market consensus to halt inflation, fixed-income investors would benefit from reinvestment of coupons at higher rates in the new higher-yield regime, so the impact from any price loss due to yields moving higher is mitigated to some extent.

Russian Equity Implications: A Dangerous Place, But a Small Slice of Emerging Markets

Among stocks, let’s first take a direct look at Russian equities. Of note, Russia accounts for less than 3% of the Emerging Market Index, so we do not expect a significantly long-term impairment to this basket. But more pointedly, the performance of the Russian equity market is back to its early-2016 lows, having fallen over 60% from its 2021 high[3]. This is a clear signal from investors regarding the significance of this situation. For perspective, the Russian index last reached those levels in 2016 primarily due to the fall of oil prices, but also due to the impact of sanctions imposed after Russia annexed Crimea.

Note that from the 2016 lows, through the peak in 2021, the Russian index price level increased 160%, and the total return was 265%, compared to total returns for the MSCI World of 130%, and the MSCI Emerging Markets index of 107%. This time period was obviously cherry-picked, to the flattery of the Russian equity market, but the point is simple: buying into fear can be rewarding.

So, what is different this time? The current invasion is more significant in scale and magnitude than what occurred in 2014. This time around, the oil price is also strong, now over $100 per barrel, partly in response to Russia’s invasion. Let’s now consider the Russian equity market by looking at its largest constituents. The top ten stocks account for over 80% of the MSCI Russia index, so it is very concentrated. Sberbank, Russia’s largest bank, will be the target of sanctions itself. Assuming sanctions weaken the Russian economy, the banking sector is very likely to suffer with higher credit costs. Since October 2021, Sberbank is now down almost 90%, with a price to earnings (P/E) ratio of just 1x and a 50% dividend yield, so the market seems to be making a binary bet on Sberbank’s demise—with the odds stacked against it.

The three large Russian energy companies (Gazprom, Lukoil, and Rosneft) also comprise 35%-40% of the index. Higher oil and gas prices are typically a boon to these companies. However, the market also seems to be making a somewhat binary bet on these three, with P/E ratios between 2-3x and dividend yields between 20%-30%. Producing such a valuable commodity, these companies will likely find a market for their oil and gas eventually, should Europe no longer be a customer, but developing new markets would take time.

A final consideration for investors is that sanctions could involve the prohibition of investors to own securities of Russian companies. For instance, the US government has banned the US listing of certain Chinese companies over concerns of national security. It is not a stretch to imagine that a similar ban could be placed on American Depositary Receipts (ADRs), American Depositary Shares (ADSs), or Global Depositary Receipts (GDRs) of Russian stocks. Similarly, Russia could impose its own restrictions on foreign investment.

In short, Russian stocks are an extremely risky place to be, even at current prices. But thankfully they do not represent a meaningful exposure to the broader emerging-market basket globally.

Global Equity Market Implications: Sector Allocations to Play a Big Role

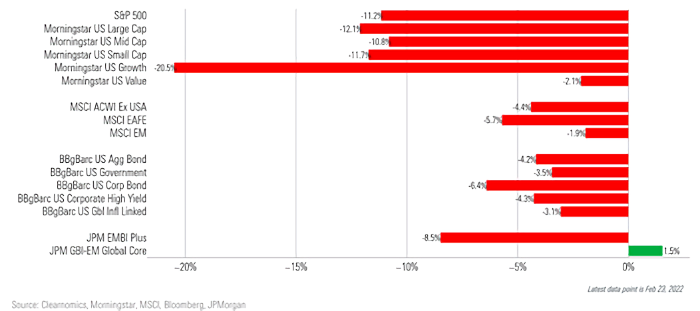

Turning to global equity markets, the US has experienced tough going in 2022 to date.

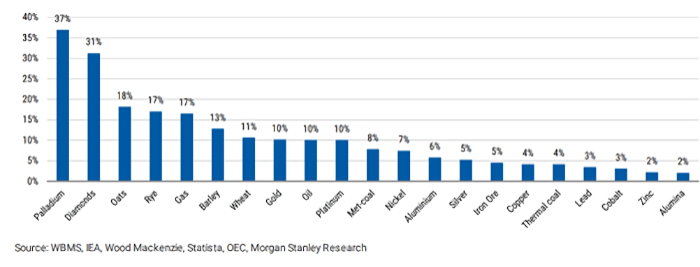

Exhibit 3 The US Investment Landscape in Early 2022 (Year-to-Date) is Ugly.

The conflict between Russia and Ukraine has certainly had a meaningful impact on the collective market psyche, but it’s far from the only factor. Inflationary pressures, the tightening monetary policy, and a challenging earnings season have all weighed on sentiment. In particular, the past decade’s big winner, US large-cap growth equities, have experienced a significant setback, underperforming their large-cap value counterparts. Interestingly, non-US equities have out-performed US equities as well.

We say all this to illustrate that equity markets, while certainly volatile of late, will likely carry sector dispersion and are unlikely to be impacted equally. However, your portfolios remain overweight energy companies as we continue to see relative value in the sector.

A Final Takeaway for Concerned Clients

Finally, we’d like to close with a word on the benefits of long-term investing. Looking back through prior geopolitical events, we find that staying invested in line with your specific strategies gives you the highest probability of investing success to achieve your goals. That’s not to say the risks aren’t worthy of your attention – they definitely are – but carrying a diversified portfolio of undervalued assets should hold you in good stead over your investing lifetime.

Exhibit 4 A Short History of Geopolitical Events and Equity Market Movements.

In this sense, the classic British statement emanating from World War II, “Keep calm and carry on,” seems quite appropriate to us as we view the investment case regarding the Russia-Ukraine conflict. A long-term approach to investing can help guard against unwise decisions overly informed by short-term fears. A fundamental, valuation-driven approach can help assess the opportunity set and potentially identify attractive opportunities.

As always, if you would like to discuss any of this in relation to your specific situation, please contact us.

Sources:

1 Source RBC Capital Markets, February 2022

2 Sourced from Morningstar Direct as at 02/24/2022

3 Sourced from the International Energy Agency, 2019.

4 Also sourced from the International Energy Agency, 2019.

5 Sourced from BP Statistical Review of World Energy, 2021

6 Sourced Capital Economics, Goldman Sachs, JP Morgan, Morgan Stanley research reports, February 2022.

7 Sourced from Federal Reserve data, to 12/31/2021

8 Sourced using the MSCI Russia index from Morningstar Direct, to 02/24/2022.

9 Again, sourced from Morningstar Direct.